All legal aspects pertaining to the deceased person are transferred to his/her heirs through the procedure called succession; liabilities and assets are both involved in the succession. Under Italian law, some members of the family are automatically entitled to a part of the assets that the deceased leaves behind. This forced share is called “legittima”. In order to make sure that all goes well with your inheritance tax in Italy, you can seek help from our Italian lawyer who can assist you through the process. Selling inherited property in Italy might seem a difficult process for which legal guidance is needed.

| Quick Facts | |

|---|---|

| Who can inherit family wealth? | Spouses, children, parents, and other relatives, depending on the family status and priority. |

|

What types of assets can be inherited? |

– properties, – money, – government bonds, – businesses, etc. |

|

What is “legitimata”? |

A forced share where some family members are automatically entitled to a part of the wealth of the deceased. |

| Fixed share in Italy | A fixed part of the estate is passed to the spouse, children, and ascendants. |

| What is forced heirship in Italy? |

The legal succession is legally distributed to close family members, no matter the place of residence or nationality. |

| What happens to the assets if there are no children? |

The surviving spouse receives 50% of the estate. |

| Distribution if there is one child in the family |

Both the child and the spouse are entitled to a 50% share of the wealth. |

| Distribution in case of more surviving children |

The spouse inherits 1/3 of the estate, while the rest of it is equally distributed to the children. |

| Assets distribution in case there are no spouses and children |

The wealth passes by to the next line of succession, respectively the parents and other siblings. |

| Distribution of assets to children from a previous marriage (YES/NO) | YES |

| Mediation and arbitration for inheritance disputes offered (YES/NO) |

YES |

| The importance of a will in Italy |

For a proper distribution of assets in the family, according to the Inheritance Law in Italy. |

| Who gets the inheritance in case there is no will? |

The priority degree is taken into account, and in this case, it is about close family members, respectively spouse, and children. |

| Inheritance tax in Italy |

4% imposed on assets worth more than EUR 1 million in the case of close family members |

| Why work with our Italian lawyers? | We can explain to you what the will entails, how the family distribution is done, and what happens from a legal point of view if there is no will. |

| Finding if there is a will left | Our Italian lawyers can inquire with the Italian Bureau and Will Register. |

|

Property disputes |

In case foreigners demand their rights (for instance children from a previous marriage), although the estate inheritance for them is not mentioned in a will. Specific documents must be provided. |

|

Who is responsible for inheritance tax in Italy? |

The heirs accepting the inherited estate |

| Can an heir renounce the right of inheritance? | Yes, especially if the tax is worth more than the property value. |

| What is alternative dispute resolution? |

Mediation and arbitration for family inheritance cases. A neutral private judge can be implicated. |

| Can forced heirs challenge a will in an Italian court of law? |

Yes, the action is called “azione di riduzione”. |

| Is a will an obligation in Italy? |

No, but it is highly recommended. |

| Can an Italian lawyer help me make a will? (YES/NO) |

YES |

| Holographic will |

Accepted by the Italian Civil Code. This is normally presented at the notary for publication when a person is deceased. |

| Is international will accepted in Italy? (YES/NO) | YES |

| Revocation of will dispositions |

Not recognized by the Italian Civil Code. A new will can be drafted. |

| Types of notarial wills |

Secret or public |

| Witnesses required when signing a will (YES/NO) |

YES |

| Assisting heirs in the first instance |

Yes, we assist in the first instance and also explain the legal rights. |

| Support for property transfer tax | On request |

Table of Contents

Entitled person to the fixed share in Italy

The people who are entitled to the statutory fixed part of the estate left by the deceased are the following:

- The spouse has the same right to the “legittima” regardless of the relationship he/she had with the deceased (separated partner or not); a divorced partner, however, does not have a right to the share;

- The children (legitimate, adopted, etc.);

- The ascendants (in case no children are alive at the time of the person’s death).

These rules apply to Italian nationals only. If the deceased is a foreigner, he/she may follow the same rules as above only if their country of origin’s law allows it.

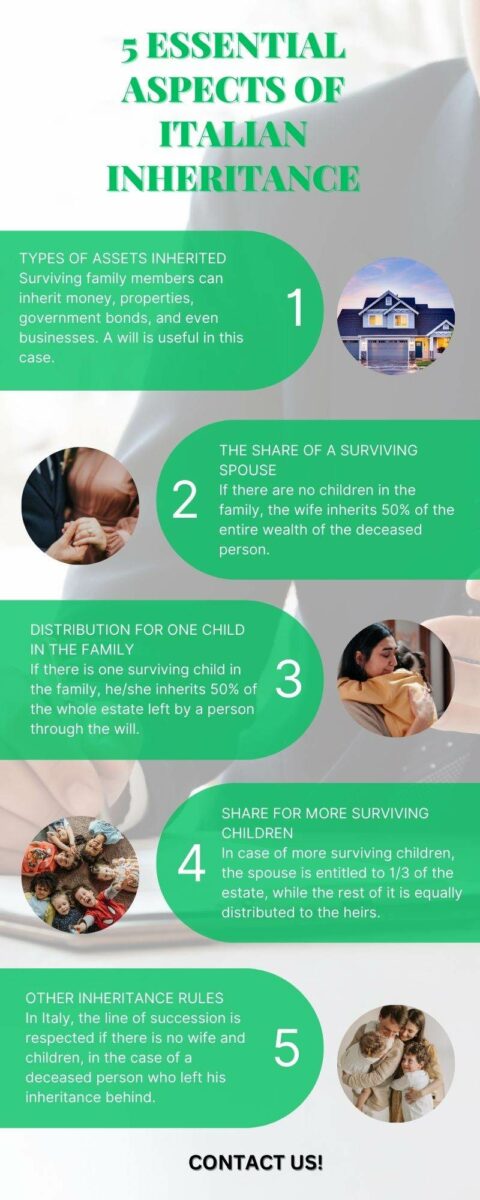

Our law firm in Italy can make sure that you follow the right steps in your inheritance case and assist you with all that might be legally necessary. Talk to us if you are interested in selling inherited property in Italy and also discover the following infographic:

Forced heirship in Italy

The principles of forced heirship are crossed with the principles of legal succession and testimony. The Civil Code of Italy mentions the close relatives that come under the definition of forced heirs such as spouses, descendants ascendants, etc. The Italian inheritance system is designed to protect close family members regardless of their place of residence or nationality. Please find below the rules of forced heirship described in the Italian Civil Code:

- In case of one surviving child and no spouse: 50% of the estate will go to the child;

- In case of two or more surviving children and no spouse: the children will get 66% of the estate in equal shares;

- In case of surviving parents and absence of children and spouse: parents will be entitled to 33% of the estate;

- In case of only one surviving spouse: he/she will get 50% of the estate;

- In case of surviving parents and spouse, but no child: 25% of the estate will go to the parents and 50% to a spouse;

- In the case of a surviving child and a spouse: 33% of the estate will go to the child and 33% will go to the spouse;

- In the case of surviving children and spouse: 50% estate will be reserved for children and 25% for the spouse.

If you are facing any complexity regarding Italian inheritance law, you can rely on our specialists. Our Italian lawyers will not only guide you, but also assist you throughout the inheritance process. We are here to tell you more about selling inherited property in Italy.

We also invite you to watch a video about inheritance in Italy:

Can forced heirs challenge a will in a court of law?

Italian law ensures that the immediate family members of a deceased person must receive their minimum statutory share of the estate while implementing the will of an Italian national. Under Italian inheritance law, the person who is entitled to transfer assets can assign his/her assets to strangers, but there is a limit to it. The testator is free to dispose of a part of his/her assets under the disposable quota. The legitimate heirs may apply to the court of law if the will infringes the minimum statutory shares that the legitimate heirs are entitled to. But please bear in mind that an Italian will that infringes on the right of forced heirs may not be invalid. So, if you want to know if an Italian will that infringes the legal limits is valid or invalid, you can get legal help from our Italian attorneys. They will help you understand the procedure of inheritance in Italy.

If forced heirs do not challenge the will, that document becomes enforceable. But if it is challenged by the heirs with a legal action called abatement legal action, then the Italian court will redistribute the assets by neglecting the prior provisions of the will.

The benefits of the Italian will

There are various advantages in making a will in Italy, following the Italian law, such as:

- It can minimize the risk of conflicts between the heirs;

- The survivors can pay less tax if the assets are left according to the “legittima”;

- It clarifies the situation with the Italian authorities; thus, the cost of the will’s execution will probably be lower.

Below is a video presentation on the distribution of inheritance in Italy:

How to distribute assets in the absence of a will?

The presence of a will makes things fast, but if the deceased person has left no will then the assets will be distributed among the individuals as per the quotas that are predetermined by the inheritance law in Italy. Please find below the degree of priority:

- First degree: This degree includes the immediate family members such as children, spouse and parents of the deceased person, if they are absent then;

- Second degree; this degree consists of siblings.

This way, Italian inheritance law ensures the presence of an heir, and for this purpose, the state goes to the sixth degree, and if still fails to find any relative then the state will take over the assets.

If you think you can inherit any property and you come in the category of any of the six degrees, you can take the services of our lawyers in Italy. They will legally assist you in the inheriting process.

Inheritance tax in Italy

The inheritance succession functions as follows: in case there is no surviving spouse, the ones who are entitled to the inheritance are: parents, siblings, and their descendants; aunts, uncles, nieces, etc, the Italian State (“Il Stato Italiano”).

These heirs will, however, have to pay inheritance tax in Italy at the moment they present the declaration to the authorities. Inheritance tax in Italy is levied on the entire estate of the deceased or on part of it, with reference to the entitled heirs, at different three flat rates.

How does inheritance tax work in Italy?

The inheritance tax in Italy is low compared to the taxes in other countries. Usually, assets are taxed only when they exceed a certain monetary value such as:

- For immediate relatives, the taxation is 4% on assets over EUR 1,000,000 in value;

- If siblings inherit the property, they would be entitled to pay a 6% tax on assets over EUR 100,000;

- Any other relative such as nieces, brothers-in-law, cousins, or grandnephews, that falls under the fourth category defined by the Italian inheritance law, must pay 6% without an allowance;

- the last bracket fits those who hold the most distant relation to the deceased and they must pay 8% of assets without allowance;

- Two more Italian inheritance taxes are added to the total, 2% mortgage and 1% cadastral. These are applied to all heirs.

Automatic heirs in Italy – what you need to know

According to inheritance in Italy, a party who owns the testator’s assets may automatically become the heir under certain conditions, without the need for express acceptance by him or her. This is the normal situation in most cases of Italian heirs, and the status of heir is granted by simply owning the property and distributing it in the family. But in order to have a better view of things, you need to seek specialist legal advice from a lawyer in Italy.

Other provisions mentioned by the Italian Inheritance Law

Italian Inheritance Law is certainly a comprehensive set of laws, which includes in detail how properties can be inherited and the exceptional cases that may arise. Here is some essential information that could help you unravel the mystery if you are faced with such a situation:

- Inheritors not living in Italy – Succession in this country is a relatively quick and easy process. However, it may happen that an inheritor does not know about the death of a relative or knows but does not own any property or does not perform an extraordinary act of administration for which he/she would automatically become heir. Such a relative may live abroad, for example, and if none of the other heirs who have accepted the inheritance requests a term from the court, that successor has up to 10 years to accept the inherited property.

- Italian succession and co-ownership of assets – Under the rules of inheritance in Italy, the inheritance or succession is fully accepted. This means that several heirs become co-owners of that estate. If, for example, the deceased person who owned two properties and a piece of land bequeathed to a husband and two children, all three become co-owners of the property and the land, taking into account that different shares are in question. Moreover, only after the acceptance of the property right over the property, the heirs can request the distribution of the assets.

- Intestate succession in Italy – There are situations in which there is no will, and the quotas are predetermined by Italian Inheritance Law. The first to speak is, of course, close family members. However, in the absence of the spouse, children, and/or parents, second-degree relatives are contacted, then third-degree relatives, if applicable. It is very important to mention that the process of succession can go up to the sixth degree before the state takes over the respective goods, an action called “intestate succession”. However, the law is on the side of the successors before the state acts.

The expertise of a lawyer with experience in succession

Without a doubt, the announcement that you have received an inheritance can be overwhelming. First of all, losing a loved family member can be a shock, and secondly, inherited goods are another important issue to digest. But in order to get over such a situation, it is recommended to ask for specialized help and to talk to a lawyer who deals with issues related to wills and inheritance.

If the situation in which the deceased leaves a will in which he mentions how the goods should be distributed in the family, the lack of this act can complicate things. The inheritance is indeed left to the children and the spouse, but if other relatives not known until then or who want to attack the will, then it is clear that legal advice is needed. An experienced lawyer on inheritance issues knows how to handle the situation presented and what would be the best solutions for the legal resolution of possible conflicts in the family.

An Italian inheritance lawyer specializing in inheritance matters can provide legal support and advice to those interested in the will, by drafting this act that will allow them to distribute the assets correctly, even outside Italy, in compliance with current EU legislation. You can learn more about inheritance in Italy from our specialists.

Why work with our lawyers in Italy

If you want transparency, professionalism, and efficiency in solving the problems you have, do not hesitate to get in touch with our specialists. Complicated inheritance cases require advice and close attention to detail in order to provide optimal solutions. You can count on our help if you have questions about inheritance tax in Italy and many more.

You can contact our lawyers regarding inheritance tax in Italy because it is complicated and there are certain tax relaxations to the relatives in some special situations.