The EORI number consists of a unique identification code that will be issued by the Italian Customs Authorities to all companies carrying out intra-community supplies of goods. The EORI registration system was created to provide easy access and this is why it is organized at the level of each EU country and a European level. Our team of Italian lawyers can assist local and foreign businessmen with more information concerning the registration of an EORI number.

Table of Contents

How to obtain an EORI number in Italy

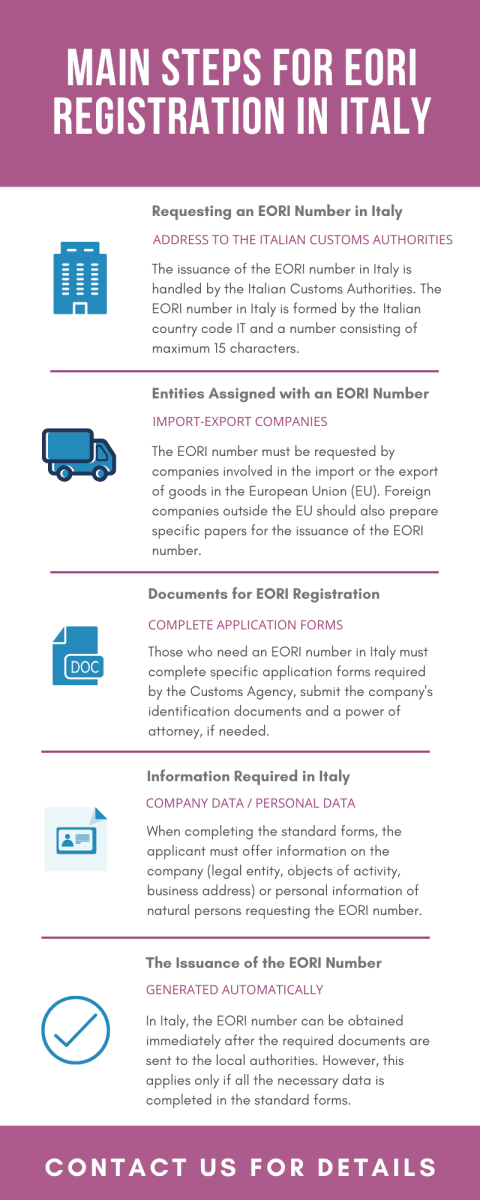

Companies operating in Italy and which are involved in trading activities must register with the EORI system and apply for an EORI number. This must be concluded before starting their trading operations in Italy. Under the Italian EORI registration system, applicants will be issued an exclusive number which will have a maximum length of 15 characters and will have Italy’s country code (IT) before it.

The EORI number in Italy resembles the system of the Italian VAT number, to ease the registration procedure. After obtaining an EORI number, the designated number must be included on all the customs declarations of the Italian companies involved in trading activities.

Any Italian operator involved in import-export activities is required to respect the same procedures and this is also available for Italian sole traders. Our law firm in Italy will provide you with information related to the EORI registration procedure available for a sole trader.

Businessmen involved in trading activities in Italy should know that the EORI number can also be requested when performing import-export activities with the following countries: Andorra, Bosnia and Herzegovina, Gibraltar, Guernsey, Iceland, Jersey, Liechtenstein, Macedonia, Moldova, Norway, and Switzerland. Our lawyers in Italy can offer legal assistance on other regulations that can be applied when trading with any of the above-mentioned states.

It is also important to know that businesses performing trading activities at an international level will need to complete the Single Administrative Document (SAD), which is a compulsory tool when importing products outside the Community area and which is used as a detailed presentation regarding the goods imported in the EU area.

Persons interested in buying a property in Italy have legal help from our specialists. Thus, our lawyers can take care of the paperwork involved, namely the sale-purchase agreement, as well as the verification of the chosen property to see if there are any disputes. Both natural persons and businessmen interested in properties can benefit from complete legal services. In addition, we can also take care of real estate due diligence and the procedures involved in verifying the respective properties.

What are the documents needed for EORI registration in Italy?

The application for EORI registration in Italy must be submitted to the local Customs Agency (Agenzia delle Dogane) before or when performing the first cross-border operation. Our team of Italian lawyers can provide information and legal advice on the documents that are necessary for the issuance of the EORI number in Italy, which are represented by the following:

- a prescribed application form and a passport or other valid identification papers – if the applicant is a natural person (the document must be submitted in original);

- in the case of Italian or foreign companies, aside from the specific application form, it is needed to provide a document stating the company’s identification data issued by the Italian Companies Register or the relevant trade register from the company’s resident country (in original);

- it is also compulsory to provide the applicant’s passport or valid ID (the person representing the applicant’s company);

- a power of attorney, if the application is submitted by a representative, a situation which can be handled through our Italian law firm.

What is the law on EORI numbers in Italy in 2024?

The legislation regulating the EORI number and the issuance and assignment of EORI numbers to economic operators in Italy is given by the EU’s regulations, which were implemented at a national level in this country. Our team of Italian lawyers can provide in-depth information on the main procedures and requirements stipulated under the following:

- the EORI system was implemented at a European level under the Regulation (EEC) No. 2913/92;

- the legislation was further amended by the European Parliament and the European Council, under Regulation (EC) No. 648/2005;

- Regulation No 312/2009 stipulates how the EU member states must assign the EORI number to economic operators;

- the above-mentioned regulation stipulates that the EORI number can be created from an alphanumeric code of a maximum 15 characters;

- regardless of the country where the code is issued, each EORI number must contain the 2 ISO codes associated with each EU member state;

- in the case of economic operators that are not established in the EU area, the issuance of the EORI number will be done following the provisions of Regulation (EEC) 2454/1993, Article 41.

A recent EU regulation concerns business owners having an EORI number in Italy. Starting from 2024, it is necessary to provide information about the postal code of the company in question. This new formality is meant to control better the export transits through the AES (Automated Export System).

What is the data required for the issuance of an Italian EORI number?

The issuance of an EORI number in Italy falls under the supervision of the Agenzia delle Dogane. The applicants, who can be natural persons or legal entities, have to complete a standard registration form. The form contains information on the applicant’s details, the type of legal personality it has, contact details, and data registered with the Register of Companies, if applicable.

Some of the basic information applicants should prepare refers to the following: the country of residence of the applicant, the VAT number – this is required only as long as the applicant is an Italian tax resident, the taxpayer ID number (necessary only in the case of Italian natural persons) and the community VAT codes – where applicable, and the name of the company.

Another section of the application is addressed only to natural persons, and information regarding the person’s identity will be required (name, address, city of residence, and others). The form will also require the person to complete the NACE code under which he or she develops a commercial activity; our team of lawyers in Italy can provide more information on the NACE codes available here.

The next section of the form is addressed to applicants from third-party countries, while the latter section, D, refers only to data registered with the Register of Companies (if the applicant is a legal entity). Section D can also refer to the personal data of natural persons if the EORI number is requested by individuals.

Once the Italian authorities have issued the EORI number to local economic operators, such information will be stored in a national database. Each EU member state has the legal obligation to send its EORI database to the Central Services of the European Commission, which stores the EORI databases from all EU member states, including Italy.

Italian economic operators with business activities subject to EU customs legislation and having an EORI number must align with the new requirements regarding the postal code by February 2024. This postal code should be registered with the relevant customs authorities, but we suggest you discuss it with our experts and eliminate any possible procedure errors.

When is the EORI number necessary in Italy?

The EORI number is required in the case of any economic operator that is involved in trading activities, as we presented earlier. The EORI number is required when dealing with the customs procedures available in each country, in matters such as lodging customs declarations at the level of the EU, and submitting and lodging papers such as the Exit Summary Declaration or the temporary storage declaration. The EORI number can also be necessary when dealing with the transportation of products by sea, air, or inland waterways.

Please note that the EORI number in Italy can be assigned immediately, as long as the applicant submits the necessary paperwork required by the local authorities. Our law firm in Italy can offer more information on the full list of documents that can be required here, based on the legal personality of the applicant.

With the assistance of our Italian lawyers, one can easily implement the new legislation modifications connected to the EORI scheme. We can guide business owners in Italy to make the solicited modifications regarding the declaration of a postal code of their companies carrying economic activities like import and export.

If you need assistance with the EORI registration application in 2024, you can contact our attorneys in Italy; our Italian law firm can assist with advice on how to fill in and submit the standard form requested by the Agenzia delle Dogane, depending on the type of entity that will apply for the EORI number (natural person or legal entity).